Short Answer

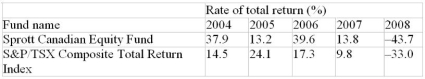

The following table presents the rates of total return in successive years from 2004 to 2008 for the Sprott Canadian Equity Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Correct Answer:

Verified

Correct Answer:

Verified

Q19: If the holding-period return on a money

Q20: Calculate the missing interest rate (to the

Q21: Calculate the term of the loan or

Q22: One of the more volatile mutual funds

Q23: Calculate the income yield, capital gain yield,

Q25: Is FV negative if you lose money

Q26: Calculate the equivalent interest rate (to the

Q27: What is the semi-annually compounded nominal rate

Q28: Calculate the equivalent interest rate (to the

Q29: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9643/.jpg" alt=" -Calculate the missing