Short Answer

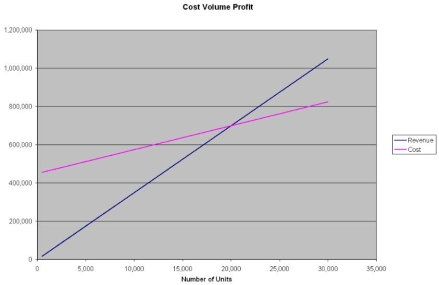

Sam manufactures a product that is selling so well, he has decided to expand his operation to 50,000 units per month. The unit cost is $7, estimated fixed costs are $1.8 mil per year and variable costs are $5 per unit. The product currently sells for $20. Use the graphical approach to CVP analysis to solve the following:

a) What is the break-even point as a percent of capacity?

b) What would the net income be at 75% capacity?

c) What would unit sales have to be to attain a net income of $100,000?

d) If sales dropped to 50% of capacity, what would the resulting net income be?

Correct Answer:

Verified

a) approx 37.5%

b) a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b) a...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Go to the textbook's OLC (www.mcgrawhill.ca/olc/jerome/) and

Q71: Determine the slope and y-intercept of each

Q72: Solve the following problem using the Contribution

Q73: Dynacan Ltd. manufactured 10,000 units of product

Q74: Kuldip's factory manufactures toys that sell for

Q76: Use the graphical method to solve the

Q77: Use the Interactive break-even Chart and its

Q78: This problem is designed to illustrate how

Q79: Solve the following problem using the Contribution

Q80: Clone Computers assembles and packages personal computer