Related Questions

Q46: After discounts of 20% and 10%, an

Q47: On March 26, Silke received an invoice

Q48: What is the break-even selling price?<br>A) $34.50<br>B)

Q49: An invoice for $2365.00 has terms 2/10,

Q50: On October 26, Sandor received an invoice

Q52: A 12½ % discount allowed on an

Q53: Jake received an invoice for $2500 with

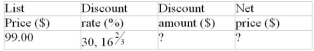

Q54: Calculate the missing values: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9643/.jpg" alt="Calculate

Q55: An item that cost $37.25 was marked

Q56: Calculate the missing values: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9643/.jpg" alt="Calculate