Multiple Choice

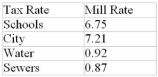

A homeowner's tax statement lists the following mill rates for various municipal services:  The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

A) $264,617

B) $265,509

C) $461,066

D) $250,000

E) $437,500

Correct Answer:

Verified

Correct Answer:

Verified

Q51: When a company calculates its earnings per

Q52: The following fraction has a terminating decimal

Q53: Convert the following to its decimal and

Q54: Through a calculation (on Canadian Individual Tax

Q55: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9643/.jpg" alt="Evaluate A)

Q57: Evaluate the answer correct to the cent:<br>-<img

Q58: Ms. Yong invested a total of $73,400

Q59: Evaluate (8 - 5 ÷ 2) ÷

Q60: Evaluate the following: (20 - 4) ×

Q61: Margot's grades and course credits in her