Multiple Choice

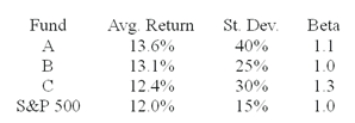

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%. You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) indeterminable

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The risk-free rate, average returns, standard deviations

Q2: The average returns, standard deviations and betas

Q3: The risk-free rate, average returns, standard deviations

Q4: The average returns, standard deviations and betas

Q5: What is the contribution of security selection

Q7: The table presents the actual return of

Q8: What is the contribution of asset allocation

Q9: The table presents the actual return of