Multiple Choice

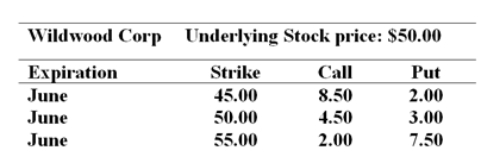

You are cautiously bullish on the common share of the Wildwood Corporation over the next several months. The current price of the share is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes: Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A) $1 050

B) $650

C) $400

D) $400 income rather than cost

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Look at the following table of data

Q2: Consider the following information relating to Interceptors

Q3: Use the following cash flow data of

Q4: The financial statements of Burnaby Mountain Trading

Q5: Consider the following information relating to Interceptors

Q7: An investor purchases a long call at

Q8: The financial statements of Burnaby Mountain Trading

Q9: Use the following cash flow data of

Q10: Use the following cash flow data of

Q11: A firm has a tax burden of