Multiple Choice

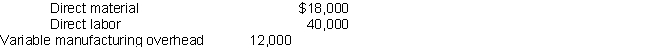

Christensen Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000 feet of one inch strips annually for $72,000. Variable costs for the leather strips are as follows: Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

Christensen is currently using 80% of its normal capacity. Christensen is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Christensen estimates that it could sell the finished bridles for $80. Christensen would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year.

What would the annual incremental income or loss be if Christensen produces the bridles?

A) $ 700 incremental income

B) $ 700 incremental loss

C) $1,800 incremental income

D) $1,800 incremental loss

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: JetTaxi is a passenger airplane line that

Q2: How are joint costs generally allocated among

Q4: Operating results for Division A of Alpha

Q5: Fizzy Drinks Co. produces a soft drink

Q6: Fit Drink Co. produces a sports drink

Q7: Sunk costs are those costs that have

Q8: All Terrain Tires manufactures three different off-road

Q9: DJH Enterprises has 3 departments. Operating results

Q10: The Consumer Products division of Sweet Dreams

Q11: All Terrain Tires manufactures three different off-road