Multiple Choice

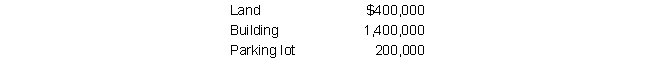

Hubert Company purchased a property (including land and building) . The company acquired the property in exchange for a 15-year mortgage for $1,800,000. Their insurance company appraised the components as follows: What should be the cost basis for the building?

What should be the cost basis for the building?

A) $1,260,000

B) $1,400,000

C) $1,200,000

D) $1,244,444

Correct Answer:

Verified

Correct Answer:

Verified

Q71: For $33,300,000, Saturn, Inc. purchased another company's

Q72: Oval Company acquired a machine that involved

Q73: On January 1, 2019, Ray, Inc. acquired

Q74: Saul Company purchased a tractor at a

Q75: Paden City Company purchased a new van

Q77: A truck that cost Starch Company $36,000,

Q78: Custom Fabrication Company has a machine that

Q79: At January 1, 2019, Flamingo Company had

Q80: Swift Corporation purchased a depreciable asset for

Q81: Golden Dollar Company purchased a machine on