Multiple Choice

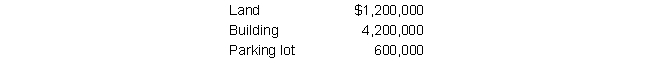

Henry Company purchased a property (including land and building) . The company acquired the property in exchange for a 15-year mortgage for $5,400,000. Their insurance company appraised the components as follows: What should be the cost basis for the building?

What should be the cost basis for the building?

A) $3,780,000

B) $3,000,000

C) $3,600,000

D) $3,633,333

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Golden Dollar Company purchased a machine on

Q82: Fantasyland Company purchased equipment with a cost

Q83: On January 1, 2017, Twinkle, Inc. purchased

Q84: On January 1, 2019, Mango Company purchased

Q85: Minerva Company purchased land and a building

Q87: On January 1, 2018, Beast Company acquired

Q88: Apple Company bought a machine on January

Q89: On April 1, 2019, Lake Co. purchased

Q90: Natalie Company purchased a tractor at a

Q91: Rite Company purchased a machine on January