Essay

Mule Company has a machine that originally cost $90,000. Depreciation has been recorded for three years using the straight-line method, with a $10,000 estimated salvage value at the end of an expected ten-year useful life. After recording depreciation at the end of the third year, Horseshoe disposes of the machine.

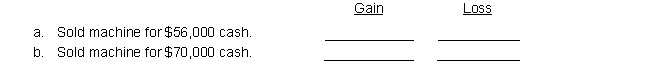

For each of the following independent disposals of the machine, place the dollar amount of the recognized gain or loss in the appropriate column. If there is no recognized gain or loss, place a zero in each column.

Correct Answer:

Verified

($90,000 - $10,000) / 10 = $8...

($90,000 - $10,000) / 10 = $8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Following is a numbered list of assets

Q55: Spencer Company purchased a tractor at a

Q56: On January 1, 2017, Alexis Company purchased

Q57: On January 1, 2019, WV Hills Company

Q58: On January 1, 2019, Philadelphia Instruments sold

Q60: Caesar Company bought a machine on January

Q61: Pokagon Store's 2019 financial statements show earnings

Q62: Durham Company purchased a new van for

Q63: At January 1, 2019, Bragg Company had

Q64: Nair Company purchased land and a building