Essay

Seligman, Inc. has a computer that originally cost $46,200. Depreciation has been recorded for five years using the straight-line method, with a $4,200 estimated salvage value at the end of an expected seven-year life. After recording depreciation at the end of the fifth year, Seligman disposes of the computer.

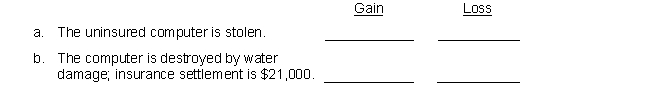

For each of the following independent disposals of the computer, place the dollar amount of the recognized gain or loss in the appropriate column. If there is no recognized gain or loss, place a zero in each column.

Correct Answer:

Verified

($46,200 - $4,200) / 7 = $6,0...

($46,200 - $4,200) / 7 = $6,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: On April 30, 2019, Peter & Sons

Q103: On July 1, 2019, Wyoming Systems Company

Q104: Holmes Packaging sold a machine for $49,500.

Q105: A truck that cost Owle Company $108,000,

Q106: Saul Company purchased a tractor at a

Q108: On January 1, 2019, Wild Blue Company

Q109: On January 1, 2018, Frontier Corporation purchased

Q110: Equipment was purchased for $72,000 on October

Q111: At January 1, 2019, Kane Company had

Q112: Golden Dollar Company purchased a machine on