Multiple Choice

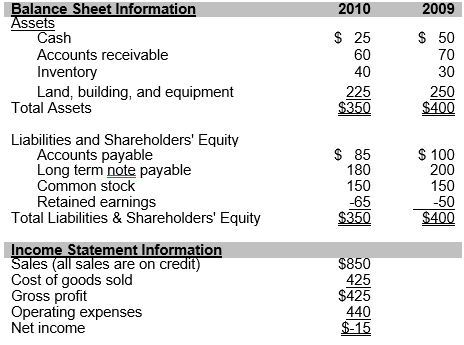

Use the information that follows taken from Camron Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems

-Calculate Camron's return on equity and return on assets for the year ended December 31, 2010.Assume that the income tax rate is 30%.Also assume that in Camron's industry, the industry average return on equity is 19% and the average return on assets is 11%.

A) Camron's return on equity and return on assets are better than average for Camron's industry.

B) Camron's return on equity and return on assets are worse than average for Camron's industry.

C) Camron's return on equity is better but return on assets is worse than average for Camron's industry.

D) Camron's return on equity is worse but return on assets is better than average for Camron's industry.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Match the correct ratio name from the

Q5: Use the information that follows taken from

Q6: Match the correct ratio name from the

Q7: Match the correct ratio name from the

Q8: Match the correct ratio name from the

Q10: Match the correct value driver category from

Q11: Use the information that follows taken from

Q12: Jefferson Company has current assets, current liabilities,

Q13: Match the correct ratio name from the

Q14: Match the correct value driver category from