Multiple Choice

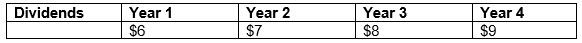

Kaitlin is contemplating investing in Cocoa Beach Tans.She estimates that the company will pay the following dividends per share at the end of the next four years and that the current price of the company's common stock, which is $100 per share, will remain unchanged.  If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

A) $130. 00

B) $119. 07

C) $85. 90

D) $82. 00

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Calculate the future value of equal semiannual

Q10: Morgan Company earns 11% on an investment

Q11: Mitch has been offered three different contracts

Q12: Interest is compounded annually.What is the total

Q13: An annuity due and an ordinary annuity

Q15: For each of the following situations in

Q16: The phone rings.You answer, "Hello." Is this

Q17: For each of the following situations in

Q18: The following computation took place:<br>$20,000 divided by

Q19: Rowan and Lisa Sharp invested $10,000 in