Short Answer

Use the following information to answer the question below.

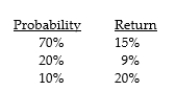

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-What is the expected return for XYZ?

Correct Answer:

Verified

(.7) (15) ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Use the following information to answer the

Q28: Use the following information to answer the

Q29: If the dividends currently paid on a

Q30: Treasury bills are currently yielding 3%, the

Q31: To settle a debt you have agreed

Q33: You are negotiating for the terms of

Q34: The coefficient of variation is best represented

Q35: The cost of common stock equity can

Q36: All else equal, an increase in fixed

Q37: How long it will take for $2,500