Short Answer

Use the following information to answer the question below.

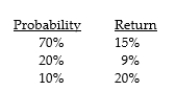

You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns:

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta.

-What is the standard deviation for XYZ?

Correct Answer:

Verified

Correct Answer:

Verified

Q97: Which of the following statements is (are)

Q98: How long will it take to triple

Q99: How much will you have at the

Q100: Use the following information to answer the

Q101: Which of the following is the best

Q103: In ten years time you'd like to

Q104: Assume your existing portfolio is valued at

Q105: You deposit $10,000 in a bank and

Q106: What are breakpoints of financing in marginal

Q107: Use the following information to answer the