Multiple Choice

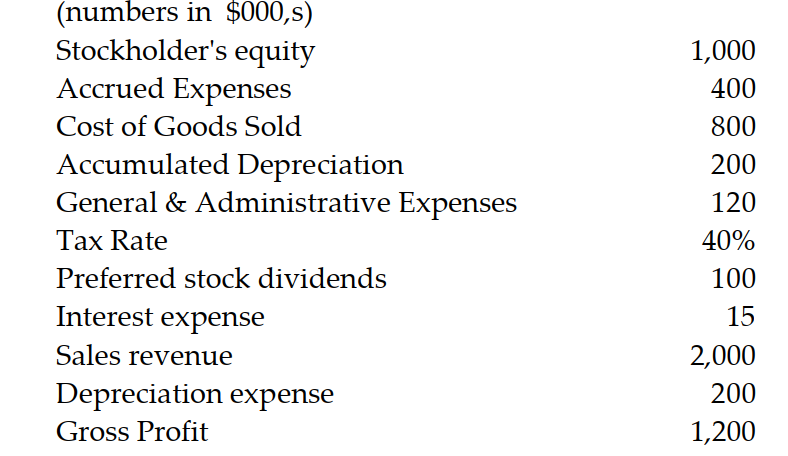

Use the following information to answer the question:

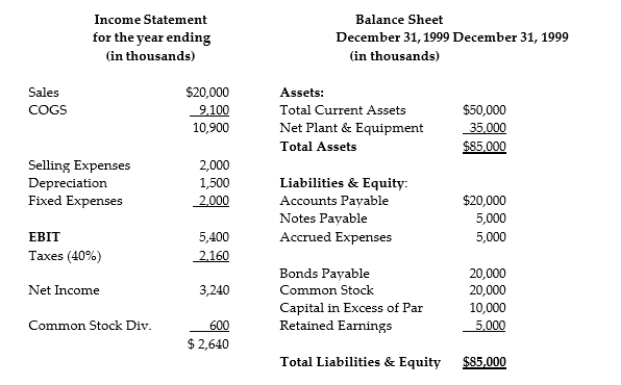

Sales for 2000 are projected to be $25,000; The firm currently uses straight line depreciation; No new equipment purchases are planned for 2000; There will be a 100% earnings distribution for 2000. The current assets, accounts payable, and accrued expenses vary at a constant percent of sales as do COGS and selling expenses. Assume that notes payable is paid off in 2000.

Sales for 2000 are projected to be $25,000; The firm currently uses straight line depreciation; No new equipment purchases are planned for 2000; There will be a 100% earnings distribution for 2000. The current assets, accounts payable, and accrued expenses vary at a constant percent of sales as do COGS and selling expenses. Assume that notes payable is paid off in 2000.

-Forecasted additional funds needed are:

A) $1,675

B) ($1,500)

C) $9,750

D) 0

Correct Answer:

Verified

Correct Answer:

Verified

Q134: A firm expects to have earnings before

Q135: Given these industry ratios:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10035/.jpg" alt="Given

Q136: Why is there considered to be a

Q137: Use the following information to answer the

Q138: Use the following information to answer the

Q139: Why would a company probably be reluctant

Q141: Given the following information for XYZ Corporation,

Q142: All other things being equal, (performance, efficiency,

Q143: Selling expenses are subtracted:<br>A) before operating income.<br>B)

Q144: A current ratio of 0.9 means:<br>A) the