Short Answer

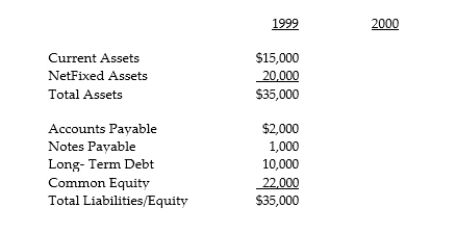

Following is the balance sheet for the end of the year 1999 for Silver Spurs, Inc.:

They have generated sales for 1999 of $35,000 resulting in net income of $15,000. Due to the difficulty associated with acquiring raw materials, Silver Spurs has experienced sluggish business that has caused fixed assets to be underutilized. Management thinks it can double sales next year through the introduction of a new product. No new fixed assets will be required and the dividend payout ratio will be 100%. Assume no additional deprecation expense will be taken in 2000. Project next year's balance sheet in the space provided above to determine the additional funding needed (AFN) for this new product. Assume all current assets and accounts payable will vary directly with sales and notes payable at the end of 1999 are paid off in 2000.

They have generated sales for 1999 of $35,000 resulting in net income of $15,000. Due to the difficulty associated with acquiring raw materials, Silver Spurs has experienced sluggish business that has caused fixed assets to be underutilized. Management thinks it can double sales next year through the introduction of a new product. No new fixed assets will be required and the dividend payout ratio will be 100%. Assume no additional deprecation expense will be taken in 2000. Project next year's balance sheet in the space provided above to determine the additional funding needed (AFN) for this new product. Assume all current assets and accounts payable will vary directly with sales and notes payable at the end of 1999 are paid off in 2000.

Correct Answer:

Verified

Correct Answer:

Verified

Q122: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10035/.jpg" alt=" Shares outstanding of

Q123: With respect to preferred stock:<br>A) it is

Q124: Producing a sales forecast is primarily a

Q125: Net income is $1,000,000 for the year,

Q126: Which is TRUE about the Canadian tax

Q128: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10035/.jpg" alt=" Shares outstanding of

Q129: A shorter average collection period is always

Q130: What is the matching principle?<br>A) The average

Q131: Use the following information to answer the

Q132: Briefly discuss the three general approaches to