Short Answer

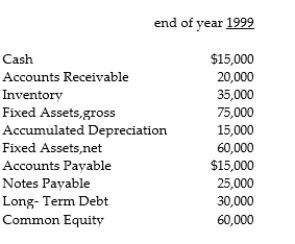

The firm currently uses straight line depreciation so that depreciation expense in 2000 will be the same as in 1999. Depreciation expense in 1999 was $5,000. Sales are expected to grow by 30% in 2000. All current assets and accounts payable are also expected to grow by 30%. All net income is paid out in dividends and no new stock issues are planned. Notes payable at the end of 1999 will be paid off in 2000. Calculate total assets and additional funds needed for 2000.

The firm currently uses straight line depreciation so that depreciation expense in 2000 will be the same as in 1999. Depreciation expense in 1999 was $5,000. Sales are expected to grow by 30% in 2000. All current assets and accounts payable are also expected to grow by 30%. All net income is paid out in dividends and no new stock issues are planned. Notes payable at the end of 1999 will be paid off in 2000. Calculate total assets and additional funds needed for 2000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Working capital includes both current and non-

Q20: The Return on Assets ratio is most

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10035/.jpg" alt=" Shares outstanding of

Q22: Retained earnings are:<br>A) the value of the

Q23: Use the following information to answer the

Q25: Why do we need a cash flow

Q26: Calculate earnings per share for the followin:<br>

Q27: Preferred stock dividends:<br>A) are deducted after net

Q28: What is EBITA?

Q29: Retained earnings were $1,500,000 at the beginning