Short Answer

On 1 January, 2019, Rata Ltd purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On 1 January, 2020, more telephone equipment was purchased to tie-in with the current system for $8,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone expense. Rata Ltd uses the straight-line method of depreciation.

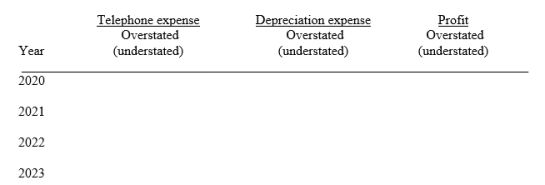

Prepare a schedule showing the effects of the error on Telephone expense, depreciation expense, and Net profit for each year and in total beginning in 2019 through the useful life of the new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: For each item listed, choose a code

Q32: Endevour Enterprises acquires land for $250,000 cash.

Q33: A plant asset with a cost of

Q34: Indicate whether each of the following expenditures

Q35: Identify the following expenditures :<br>-Painting and lettering

Q37: Winningham Ltd sold the following two machines

Q38: Select of Section of the statement of

Q39: Natural resources are regarded as a special

Q40: A plant asset acquired on October 1,

Q41: For each item listed, choose a code