Short Answer

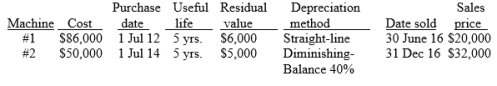

Chuck's Timber Mill sold two machines in 2019. The following information pertains to the two machines:

Required:

Required:

(a) Calculate the depreciation on each machine to the date of disposal. The financial year ends 31 December.

(b) Prepare the journal entries in 2019 to record 2019 depreciation and the sale of each machine.

Correct Answer:

Verified

Correct Answer:

Verified

Q84: Which of the following is not a

Q85: Match the descriptions with their terms:<br>-Must be

Q86: Biological assets cannot be recognised unless the

Q87: Presented below are selected transactions for Ronnen

Q88: Match the descriptions with their terms:<br>-Process of

Q90: Equipment was purchased for $45,000. Freight charges

Q91: Equipment with a cost of $160,000 has

Q92: Outback Airlines purchased a 747 aircraft on

Q93: Cole Company buys land for $50,000 on

Q94: a. A machine that cost $18,000 and