Essay

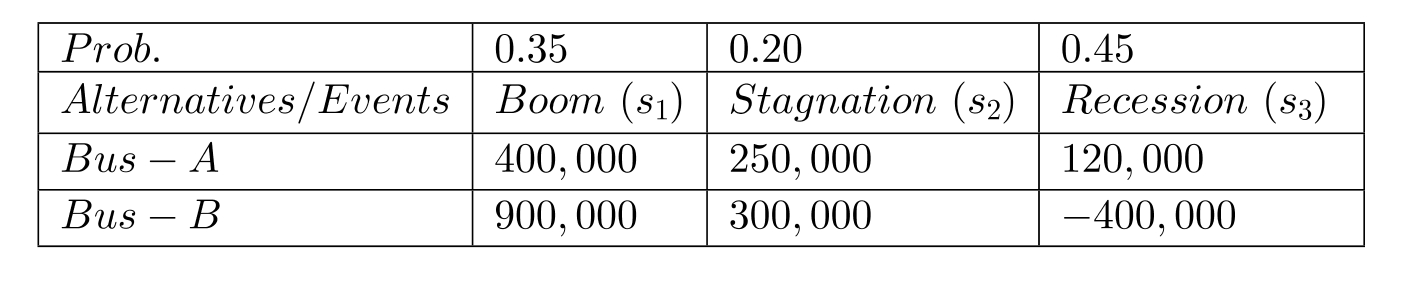

In the following decision problem, you are considering two business opportunities at the end of your business education. One is a safe but less lucrative business (Bus-A) and the other a risky but attractive business (Bus-B). The expected five-year revenue differs significantly depending on boom, stagnation or recession in the national economy. The following table gives the payoff matrix and probabilities.

(A) Draw a decision tree.

(B) What is the best decision maximizing expected monetary value?

(C) What is the expected monetary value?

(D) What is the EVPI?

(E) What is the expected opportunity loss for each decision?

(F) What is the decision that minimizes expected opportunity loss?

Correct Answer:

Verified

(A) Draw a decision tree.

(B) EMV(Bus-A)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(B) EMV(Bus-A)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Expected payoff corresponding to various levels of

Q28: Expected value of perfect information (EVPI) cannot

Q29: Projected payoff corresponding to various levels of

Q30: Prior probabilities for economic boom, moderate

Q31: Projected payoff corresponding to various levels

Q33: In problems involving decision making under complete

Q34: Risk in the context of decision theory

Q35: In pruning (evaluating) a decision tree, you

Q36: Projected payoff corresponding to various levels

Q37: Prior probabilities for economic boom, moderate