Essay

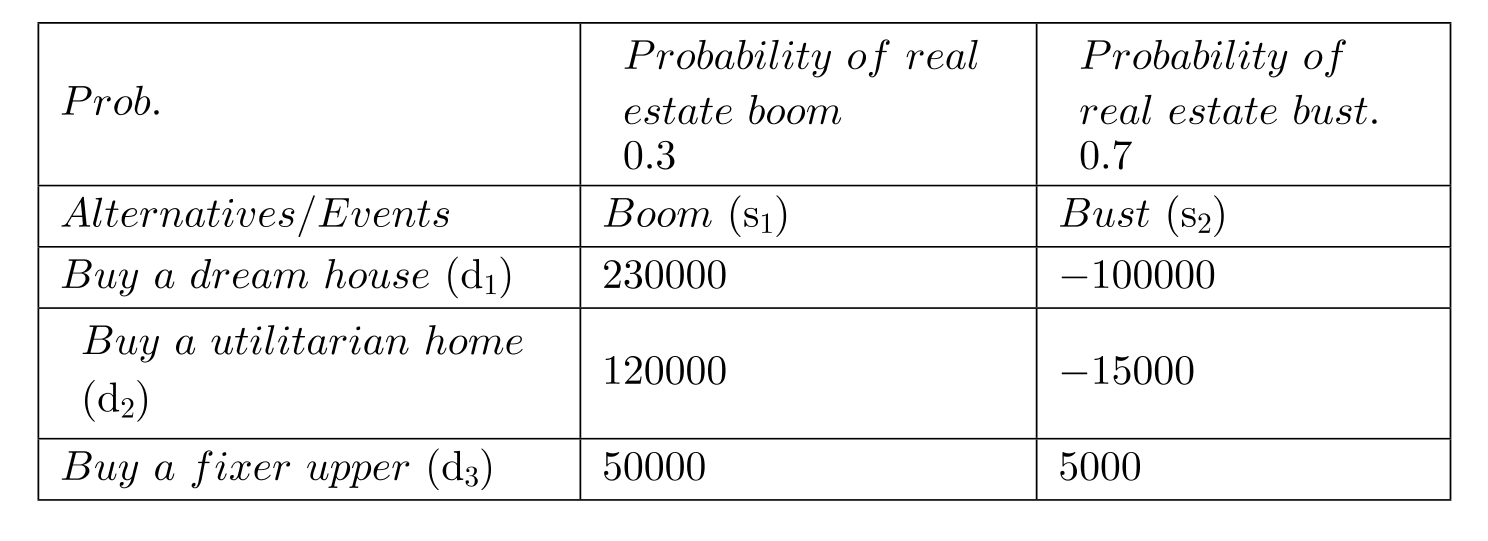

Kathy Smith is contemplating her first major purchase of a lifetime, her own primary residence. Her planning horizon is 5 years, and she plans to sell the house in 5 years. She is wondering whether it will be a real estate boom or bust in the next 5 years. Her current probability estimate is 0.3 for boom and 0.7 for bust. The following table gives the net profit she expects to make for each combination of decision and random outcome.

(A) Find the EMV maximizing decision and the value of the best EMV.

(B) Using sensitivity analysis, find the range of probability for random outcome (Boom) and the corresponding EMV maximizing decision for each range.

Correct Answer:

Verified

(A)

EMV maximizing decision: buy a ut...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

EMV maximizing decision: buy a ut...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Expected opportunity loss is always less than

Q50: Jim Smith is weighing all the

Q51: Expected value of perfect information can be

Q52: In a decision tree, a circle represents

Q53: In pruning (evaluating) a decision tree, you

Q54: Prior probabilities for economic boom, moderate

Q56: One can solve a decision theory problem

Q57: Expected payoff corresponding to various levels

Q58: States of nature are decision alternatives under

Q59: Projected payoff corresponding to various levels of