Multiple Choice

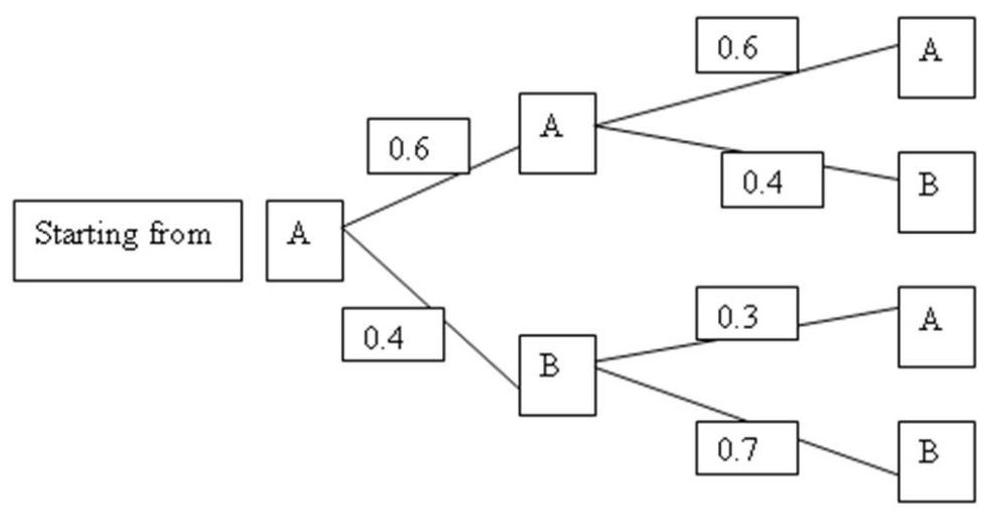

Jim Cramer, a stock analyst, models the movement of the closing price in NYSE of the stock WidgetsR-Us Inc. (symbol: WRU) as a Markov chain with a transition time of 1 day. There are two states in this Markov system-State A, the closing price increased or stayed the same from the previous day and State B, the closing price decreased from the previous day. Suppose that the system is on State A at the end of today, what is the probability that it will be in State B after two trading days (48 hours) ?

A) 0.52

B) 0.24

C) 0.28

D) 0.40

Correct Answer:

Verified

Correct Answer:

Verified

Q5: XYZ Inc. hires only retired people for

Q6: A tree diagram is a very useful

Q7: Goldman Sachs commodity analyst John Roberts

Q8: Joe Smith, a loyal lessee of American

Q9: XYZ Inc. hires only retired people

Q11: Short term behavior of a Markov system

Q12: Judy Jones purchases groceries and pop exactly

Q13: Newsweek and Time are two competing,

Q14: Judy Jones purchases groceries and pop exactly

Q15: In Markov chains having absorbing states and