Short Answer

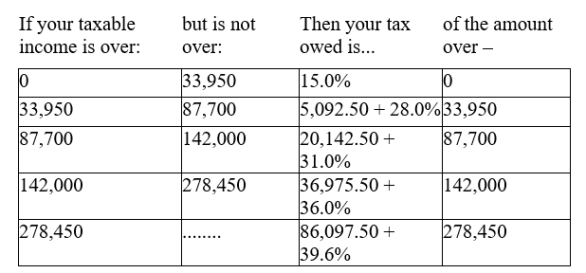

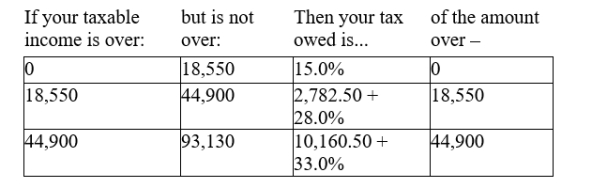

Use the appropriate Tax Rate Schedule below to answer the questions.

Schedule Z-A - Use if your filing status is married filing jointly

Schedule Z-B - Use if your filing status is single

A) Find the taxed owed by someone whose filing status is married filing jointly and whose taxable income is $203,500.

B) Find how much more or less this taxpayer would pay with a flat tax of 18%. If the 18% flat tax is less enter your answer as negative.Round answers to 2 decimal places.

Correct Answer:

Verified

A. $ 59,11...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: From the graph shown, identify where y1

Q3: Solve the system.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg" alt="Solve the

Q4: The Wisconsin Agricultural Extension office publishes recommendations

Q5: Solve the system by elimination.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg"

Q6: Solve the system by graphing.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg"

Q8: Solve the system of equations.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg"

Q9: Create a piecewise function to describe the

Q10: Create an inequality to describe the shaded

Q11: Solve this system of equations by sketching

Q12: Select an inequality to describe the shaded