Short Answer

Use the appropriate Tax Rate Schedule below to answer the questions.

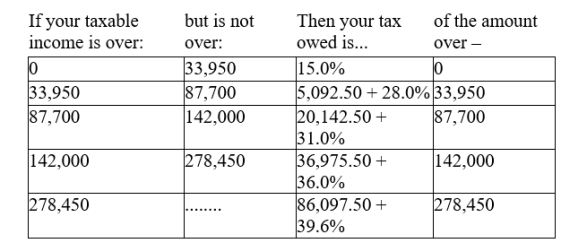

Schedule Z-A - Use if your filing status is married filing jointly

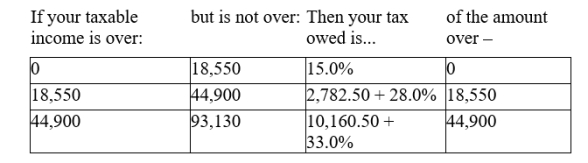

Schedule Z-B - Use if your filing status is single

A) Find the taxed owed by someone whose filing status is single and whose taxable income is $48,000.

A) Find the taxed owed by someone whose filing status is single and whose taxable income is $48,000.

B) Find how much more or less this taxpayer would pay with a flat tax of 20%. If less enter your answer as negative.Round answers to 2 decimal places.

Correct Answer:

Verified

A. $ 11,18...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Select an inequality to describe the shaded

Q57: Use an inequality to describe the shaded

Q58: Determine which ordered pairs are solutions to

Q59: Create a graph for the piecewise function.<br>

Q60: From the graph shown, identify where y1

Q62: On the grid provided, graph and shade

Q63: Estimate the solution of the system of

Q64: Solve the system.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg" alt="Solve the

Q65: Solve the system.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9987/.jpg" alt="Solve the

Q66: Determine the number of solutions of the