Multiple Choice

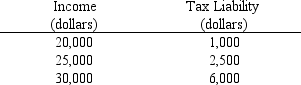

Use the table below to choose the correct answer.

The marginal tax rate on income in the $25,000 to $30,000 range is

A) 10 percent.

B) 20 percent.

C) 50 percent.

D) 70 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Currently, federal and state gasoline taxes (imposed

Q21: The "incidence of a tax" is the

Q92: A payment the government makes to either

Q137: Both price floors and price ceilings, when

Q146: The burden of a tax will fall

Q162: Use the figure below to answer the

Q243: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18

Q249: Suppose that the federal government grants a

Q274: In the two decades following 1990, subsidized

Q283: A tax is levied on products A