Multiple Choice

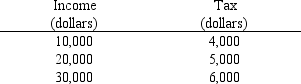

Use the table below to choose the correct answer.

For the income range illustrated,the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) progressive up to $20,000 but regressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: If a household has $40,000 in taxable

Q10: The deadweight loss (or excess burden) resulting

Q28: Use the figure below illustrating the impact

Q48: If the federal government placed a 50

Q143: A regressive tax<br>A) taxes individuals with higher

Q149: A tax for which the average tax

Q150: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q199: During the Prohibition period (when the production

Q215: An income tax is defined as regressive

Q219: A tax for which the average tax