Multiple Choice

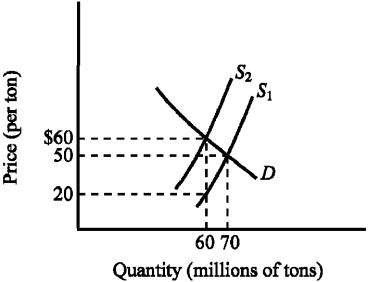

Use the figure below to answer the following question(s) .

Figure 4-8

-Refer to Figure 4-8.The supply curve S₁ and the demand curve D indicate initial conditions in the market for soft coal.A $40-per-ton tax on soft coal is levied,shifting the supply curve from S₁ to S₂.Which of the following states the actual burden of the tax?

A) $10 for buyers and $30 for sellers

B) $30 for buyers and $10 for sellers

C) The entire $40 falls on sellers.

D) The entire $40 falls on buyers.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Figure 4-18 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-18

Q20: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-22

Q91: According to the Laffer curve,<br>A) an increase

Q97: The City of Greenville needs to raise

Q126: Figure 4-24<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3951/.jpg" alt="Figure 4-24

Q130: When prices of products are set below

Q158: Rent control applies to about two-thirds of

Q193: An income tax is progressive if the<br>A)

Q200: If the federal government began granting a

Q218: If Neleh's income increases from $60,000 to