Multiple Choice

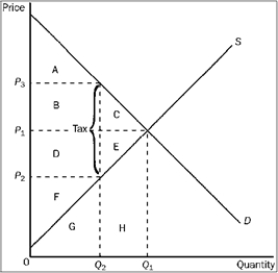

Figure 4-25

-Refer to Figure 4-25. The tax causes a reduction in consumer surplus that is represented by area

A) A.

B) B + C.

C) D + E.

D) F.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q193: An income tax is progressive if the<br>A)

Q194: A market that operates outside the legal

Q195: An income tax is proportional if<br>A) the

Q196: When a price floor is above the

Q197: Taxes adversely affect the allocation of resources

Q199: If political officials want to minimize the

Q200: If the federal government began granting a

Q201: Which of the following is the most

Q202: Bill the butcher is upset because the

Q203: The term "deadweight loss" or "excess burden"