Multiple Choice

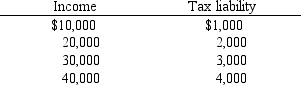

Use the table below to choose the correct answer.

For the income range illustrated,the tax shown here is

A) regressive.

B) proportional.

C) progressive.

D) progressive up to $30,000 but regressive beyond that.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: The Laffer curve illustrates the relationship between<br>A)

Q77: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-20

Q106: Figure 4-23 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-23

Q138: Figure 4-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7348/.jpg" alt="Figure 4-21

Q151: If an increase in the government-imposed minimum

Q220: Use the figure below to answer the

Q224: If there was an increase in the

Q245: The market pricing system corrects an excess

Q262: Suppose the federal excise tax rate on

Q263: The average tax rate is defined as<br>A)