Multiple Choice

The partners decide to dissolve the partnership. They are offered £40,000 for the building and the fixtures

and fittings. Aoife agrees to take over one car at a value of £2,500 and Declan takes over the other

remaining car at a value of £2,000. It turns out that £2,500 of the trade receivable are bad and the sundry

payables have promised to give the partners, on average 10% discount on settlement of the debt owed to

them if it is paid for on the 1 January 20X2. The loan will be paid off in full on that date. All the monies

in and out will occur on the 1 January 20X2. The dissolution expenses amount to £2,200.

Questions 1 to 4 should be answered from this following information

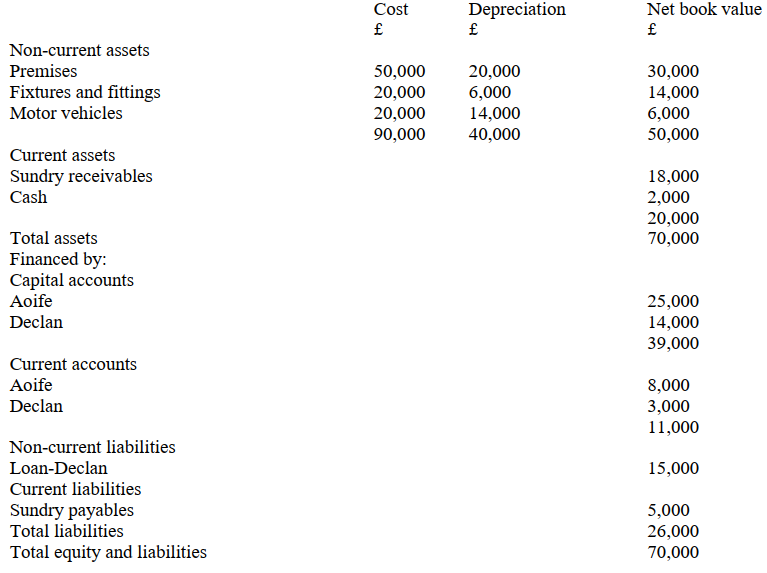

Aoife and Declan are in partnership, sharing profits equally. Their draft statement of financial position is

as follows:

-What payment/receipt from/to Aoife is required to close her capital account on the dissolution of the partnership?

A) Receipt from Aoife of £25,500

B) Payment to Aoife of £17,500

C) Payment to Aoife of £20,000

D) Payment to Aoife of £25,500

Correct Answer:

Verified

Correct Answer:

Verified

Q3: When there is a credit balance brought

Q4: A partnership has reported profit for the

Q5: What is the main purpose of a

Q6: When there is a credit balance carried

Q7: The partners decide to dissolve the partnership.

Q9: The partners decide to dissolve the partnership.

Q10: In a company's statement of financial position

Q11: The partnership is being dissolved and converted

Q12: In the books of the partnership, how

Q13: In a partnership the double entry to