Multiple Choice

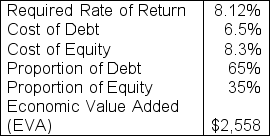

Smith Industries is in desperate need of a new press machine for their production department. The manager has been asked to select the most favorable option while keeping in mind that any decision made may also impact their department's evaluation. Given this, the manager knows that performing a thorough analysis is crucial. A machine could be purchased from Grove Inc. for a total cost of $9,677 and would generate Operating Income of $3,705. A different machine could be purchased from Forest Inc. for a total cost of $9,003 and would generate Operating Income of $3,432. The company has provided the following information:  What is the tax rate for the press machine from Grove? Assume the company uses an effective tax rate that is rounded to the four places. (Do not round intermediate calculations.)

What is the tax rate for the press machine from Grove? Assume the company uses an effective tax rate that is rounded to the four places. (Do not round intermediate calculations.)

A) 12.34%

B) 14.66%

C) 17.84%

D) 18.62%

Correct Answer:

Verified

Correct Answer:

Verified

Q65: A company is debating replacing the GPS

Q66: Once companies have decentralized, they find themselves

Q67: Oscar is the manager of the component

Q68: The retail department of Dunder Corp. has

Q69: The Production Department of Ollie Corp. has

Q71: The printing division at a small factory

Q72: In a well-structured organization, management will strive

Q73: What is a responsibility center, and what

Q74: Turner Inc. is a factory that creates

Q75: The Tortilla Chip business unit at Chipz