Multiple Choice

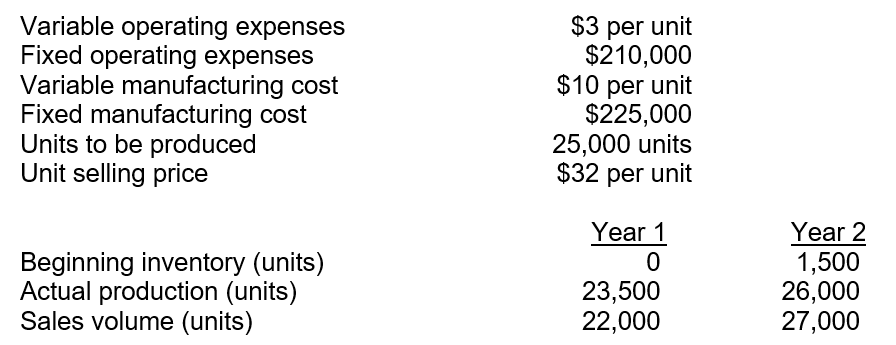

Crystal, the owner of Crystal Clean, is planning for the next year. She uses the absorption method to determine the evaluation of employees and how much to increase their hourly wage. She has budgeted the following information:  There were no price or efficiency variances for either year. Crystal writes off any fixed MOH volume variance directly to COGS. Calculate the adjusted COGS for year 1.

There were no price or efficiency variances for either year. Crystal writes off any fixed MOH volume variance directly to COGS. Calculate the adjusted COGS for year 1.

A) $286,000.

B) $418,000.

C) $431,500.

D) $484,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Determining the numerator and denominator when calculating

Q63: Practical capacity<br>A)typically leads to an unusually large,

Q64: When using variable costing and absorption costing,

Q65: Crystal, the owner of Crystal Clean, is

Q66: Stivrins Company is in the process of

Q68: An example of activity capacity that is

Q69: When the units produced is greater than

Q70: Vasquez Supply Company hired Adrianna as its

Q71: Income statements, using absorption costing, are sometimes

Q72: Theoretical capacity<br>A)results in lower, more attainable production