Multiple Choice

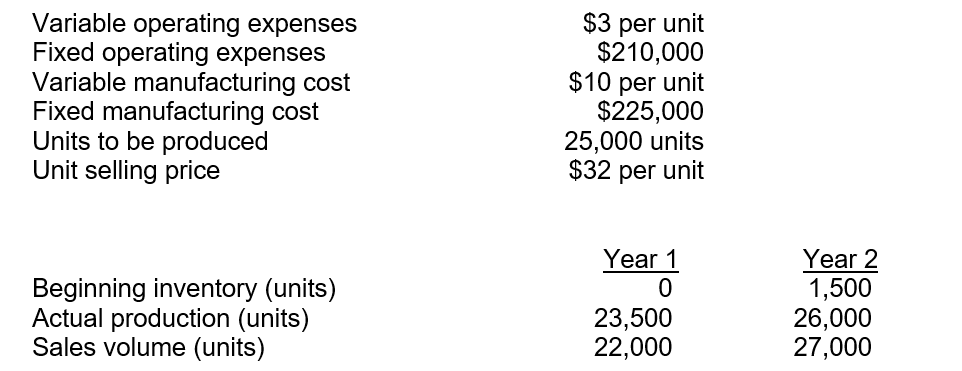

Crystal, the owner of Crystal Clean, is planning for the next year. She uses the absorption method to determine the evaluation of employees and how much to increase their hourly wage. She has budgeted the following information:  There were no price or efficiency variances for either year. Crystal writes off any fixed MOH volume variance directly to COGS. Calculate the adjusted COGS for year 2.

There were no price or efficiency variances for either year. Crystal writes off any fixed MOH volume variance directly to COGS. Calculate the adjusted COGS for year 2.

A) $351,000.

B) $495,000.

C) $513,000.

D) $594,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q97: Crystal, the owner of Crystal Clean, is

Q98: Stanczyk Inc. started operations in January 2025.

Q99: Crystal, the owner of Crystal Clean, is

Q100: BioClinic sells its product for $80 per

Q101: Malena is working on budgeting for the

Q103: Operating income, using absorption costing, is gross

Q104: Kristin, the accountant for XYZ Industries, is

Q105: Variable costing<br>A)is used for GAAP reporting purposes.<br>B)is

Q106: BioClinic sells its product for $80 per

Q107: The fixed MOH volume variance measures<br>A)the difference