Multiple Choice

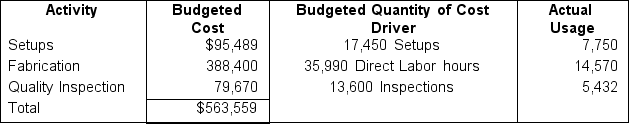

Robert has been evaluating all costing data after he realized how small his margin for dinner plates had become. These plates have become the focal point for the organization so Robert has a vested interest in increasing the margin per plate. He has spent time aligning with beneficial suppliers and reducing his material cost and streamlined labor usage in a successful effort to minimize labor costs as well. The remaining task in this journey to improve margin is to evaluate the allocation of Manufacturing Overhead (MOH) costs that are estimated to be $563,559.00 for the year. Three main cost drivers and their related information are as follows: How much of the MOH costs would be allocated to dinner plates if Robert chooses to continue using a single plant-wide rate based upon Direct Labor hours? (If required, round calculations to two decimal places.)

How much of the MOH costs would be allocated to dinner plates if Robert chooses to continue using a single plant-wide rate based upon Direct Labor hours? (If required, round calculations to two decimal places.)

A) $122,533.70

B) $157,210.30

C) $206,430.12

D) $228,166.20

Correct Answer:

Verified

Correct Answer:

Verified

Q85: Trojan Corp. creates miniature wooden figurines that

Q86: Susan is the controller for Simply Devine

Q87: Adopting Activity-Based Costing (ABC) involves four steps.

Q88: John is currently working on assembling some

Q89: David owns a small boutique that sells

Q91: Imagine that you are looking at the

Q92: Activity-based costing (ABC) is often chosen in

Q93: Charles has been compiling year-end financial data

Q94: Susan is an accountant for Spruce, Inc.,

Q95: Sparrow, Inc. produces birdseed that it sells