Multiple Choice

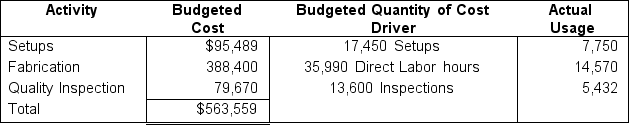

Robert has been evaluating all costing data after he realized how small his margin for dinner plates had become. These plates have become the focal point for the organization so Robert has a vested interest in increasing the margin per plate. He has spent time aligning with beneficial suppliers and reducing his material cost and streamlined labor usage in a successful effort to minimize labor costs as well. The remaining task in this journey to improve margin is to evaluate the allocation of manufacturing overhead (MOH) costs that are estimated to be $563,559.00 for the year. Three main cost drivers and their related information are as follows: How much of the MOH costs would be allocated to dinner plates if Robert chooses to utilize an activity-based approach instead of a single plant-wide rate? (If required, round calculations to two decimal places.)

How much of the MOH costs would be allocated to dinner plates if Robert chooses to utilize an activity-based approach instead of a single plant-wide rate? (If required, round calculations to two decimal places.)

A) $220,873.34

B) $228,166.20

C) $231,434.32

D) $563,559.00

Correct Answer:

Verified

Correct Answer:

Verified

Q107: Stevens Services is a call center that

Q108: Sparrow, Inc. produces birdseed that it sells

Q109: Briefly describe what a cost driver is,

Q110: Pazzo's Pizza utilizes Activity-Based Costing (ABC) to

Q111: Peacock Inc. is a contracting business that

Q113: Two staff accountants, Michael and Anthony, are

Q114: Paul runs the call center for Igloo

Q115: Bill owns Owens Construction, a small general

Q116: Eugene is the manager for Levy Corp,

Q117: Josephine has been investigating a potential switch