Multiple Choice

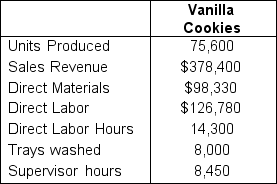

Josephine has been investigating a potential switch to Activity-Based Costing (ABC) for the cookie company where she works. She has decided to focus on their biggest seller, vanilla cookies, before moving forward with this decision. She has gathered the following pertinent financial data: Josephine determined that there are three key activities where Manufacturing Overhead (MOH) costs can be divided along with the total activity for the year: cutting, $34,500 (25,600 direct labor hours) ; washing cookie trays, $37,900 (15,780 trays washed) ; and wages for the supervisors, $24,600 (12,630 supervisor hours) . Josephine would like to decide soon. What is the total amount of MOH allocated to the vanilla cookies using ABC? (Do not round the calculations.)

Josephine determined that there are three key activities where Manufacturing Overhead (MOH) costs can be divided along with the total activity for the year: cutting, $34,500 (25,600 direct labor hours) ; washing cookie trays, $37,900 (15,780 trays washed) ; and wages for the supervisors, $24,600 (12,630 supervisor hours) . Josephine would like to decide soon. What is the total amount of MOH allocated to the vanilla cookies using ABC? (Do not round the calculations.)

A) $54,944.11

B) $55,087.50

C) $97,000.00

D) $98,330.00

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Eagleton Inc. is a retail business that

Q54: Roland's company makes and sells scarves, and

Q55: Magic Golf is a small putt putt

Q56: Lumins, Inc. is a manufacturer of fine

Q57: Swanson Corp. manufactures and sells decorative bird

Q59: Two staff accountants, Michael and Anthony, are

Q60: An organization currently employs traditional costing for

Q61: John is a carpenter who specializes in

Q62: Mallard, Corp. produces duck-friendly pellets that it

Q63: What is the purpose of traditional job