Multiple Choice

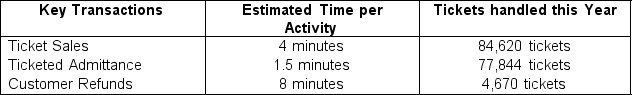

The Concrete Rose has been a staple of their community for several decades. As the owner retires and promotes his daughter Moira to CEO of this successful music venue, the management staff has prepared suggestions for improvements. At the top of their list is the implementation of Time-Driven Activity-Based Costing (TDABC) over their current traditional costing methods. With this new change, the management team believes they can optimize their earnings. They compiled the following data about their identified key activities: The Concrete Rose spent $389,500 to operate the ticketing department, and these resources created a capacity of 495,000 minutes. How much total cost would be allocated to the key activities? (If required, round calculations to two decimal places.)

The Concrete Rose spent $389,500 to operate the ticketing department, and these resources created a capacity of 495,000 minutes. How much total cost would be allocated to the key activities? (If required, round calculations to two decimal places.)

A) $326,428.00

B) $389,500.00

C) $389,547.96

D) $391,050.00

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Susan is an accountant for Spruce, Inc.,

Q79: Daisy Company is a mid-sized organization that

Q80: In order to operate its customer support

Q81: In calculating the activity-based rate (cost driver

Q82: Eugene is the manager for Levy Corp,

Q84: As a company is determining which costing

Q85: Trojan Corp. creates miniature wooden figurines that

Q86: Susan is the controller for Simply Devine

Q87: Adopting Activity-Based Costing (ABC) involves four steps.

Q88: John is currently working on assembling some