Multiple Choice

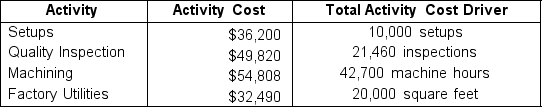

The management team at Diamondz, Inc., a manufacturer of fine jewelry, is gearing up for their new fiscal year. Part of their yearly process includes analyzing the past year's performance and seeking ways to improve upon existing processes. Diamondz specializes in two products: diamond rings and diamond necklaces. Management has decided that they would like to begin using Activity-Based Costing (ABC) for budgeting their Manufacturing Overhead (MOH) costs. They have narrowed their key activities to the following: Diamondz has determined that the 18,900 rings they produce will use the following: $130,000 of direct materials, $52,600 of direct labor, 6,200 setups, 12,400 inspections, 26,350 machine hours, and 12,444 square feet. The 15,680 necklaces they produce will use the following: $227,400 of direct materials, $86,700 of direct labor, 3,800 setups, 9,060 inspections, 16,350 machine hours, and 7,556 square feet.

Diamondz has determined that the 18,900 rings they produce will use the following: $130,000 of direct materials, $52,600 of direct labor, 6,200 setups, 12,400 inspections, 26,350 machine hours, and 12,444 square feet. The 15,680 necklaces they produce will use the following: $227,400 of direct materials, $86,700 of direct labor, 3,800 setups, 9,060 inspections, 16,350 machine hours, and 7,556 square feet.

What is the total manufacturing cost for diamond rings? (If required, round calculations to two decimal places.)

A) $105,099.28

B) $169,259.00

C) $179,199.28

D) $287,699.28

Correct Answer:

Verified

Correct Answer:

Verified

Q124: Your client, a factory that produces chips

Q125: Trojan Corp. creates miniature wooden figurines that

Q126: Activity-based costing (ABC) will utilize cost drivers

Q127: If a business wants to use Time-Driven

Q128: Stevie has been allocating Manufacturing Overhead (MOH)

Q130: When considering implementing activity-based costing, management should

Q131: Susan has gathered the following data about

Q132: John is a carpenter who specializes in

Q133: Swanson Corp. manufactures and sells decorative bird

Q134: Time-Driven Activity-Based Costing (TDABC) requires its users