Essay

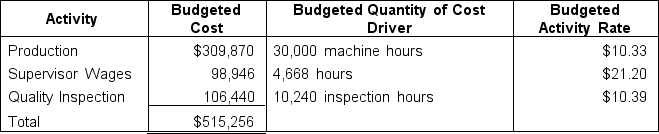

Lilly Corp. manufactures office supplies that it specifically creates for recent college graduates. One of their most popular items in recent years is an annual planner that is accompanied by accessories such as stickers and highlighters. Lilly currently uses a single plant-wide rate of $14 per Direct Labor (DL) hour to allocate their Manufacturing Overhead (MOH) costs. Sarah, the controller, would like to determine whether a switch to Activity-Based Costing (ABC) would prove to be a beneficial planning tool for Lilly Corp. moving forward. Sarah has identified three key activities that would be used for ABC: Production, Supervisor Wages, and Quality Inspections. Sarah has compiled the following budgeted MOH cost data for the annual planner:

The actual usage of resources for manufacturing the annual planner includes $27,360 in DM costs; 37,000 DL hours; 28,500 machine hours; 4,500 supervisor hours; and 9,800 inspection hours.

The actual usage of resources for manufacturing the annual planner includes $27,360 in DM costs; 37,000 DL hours; 28,500 machine hours; 4,500 supervisor hours; and 9,800 inspection hours.

a. Allocate MOH costs to the production of the annual planner using the previous plant-wide rate.

b. How will MOH costs be allocated to the production of the annual planner using ABC rates?

c. What could account for the difference between these two different allocations? Which should Sarah advise Lilly Corp. to use moving forward?

Correct Answer:

Verified

a. $518,000.00

To calculate Lilly's budg...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

To calculate Lilly's budg...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Tech Squad is a regional call center

Q71: Shinebright, Inc., a company that produces sunscreen

Q72: A company is currently using traditional costing

Q73: Aubrey is an accountant for Arbor Town,

Q74: The Manufacturing Overhead (MOH) T-account for companies

Q76: In a traditional simple costing system, a

Q77: Eagleton Inc. is a retail business that

Q78: Susan is an accountant for Spruce, Inc.,

Q79: Daisy Company is a mid-sized organization that

Q80: In order to operate its customer support