Multiple Choice

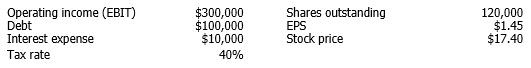

The following information applies to Shilling Medical Supplies: The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40) . The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40) . The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

A) $15.00

B) $16.25

C) $17.40

D) $18.00

E) $20.88

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Boothe Co. expects EBIT of $3,000,000 for

Q20: Foulke Enterprises has no debt, and is

Q21: Differentiate between business and financial risks

Q22: Which of the reasons listed below support

Q23: Kapler Inc. expects EBIT of $2,000,000 for

Q25: Cabrera Construction has a capital budget of

Q26: Are capital structures around the world generally

Q27: Embree Inc.'s value with no debt is

Q28: Differentiate between internal and external corporate dividend

Q29: Should a multinational firm develop an optimal