Multiple Choice

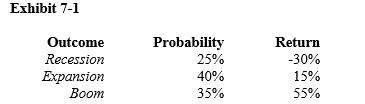

-Given Exhibit 7-1, what is the expected return?

A) 13.00%

B) 15.96%

C) 16.00%

D) 17.75%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-2,

Q2: An investor has $10,000 invested in Treasury

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-6,

Q5: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-1,

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-3,

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-2,

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10284/.jpg" alt=" -Given Exhibit 7-1,

Q10: The beta of the risk-free asset is:<br>A)

Q11: If the market portfolio has an expected