Multiple Choice

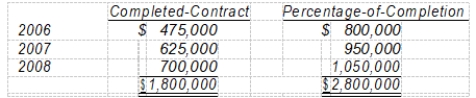

During 2008, a construction company changed from the completed-contract method to the percentage-of-completion method for accounting purposes but not for tax purposes. Gross profit figures under both methods for the past three years appear below: Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

A) $600,000 on the 2008 income statement.

B) $390,000 on the 2008 income statement.

C) $600,000 on the 2008 retained earnings statement.

D) $390,000 on the 2008 retained earnings statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A change in accounting principle results when

Q3: When a company changes an accounting principle,

Q4: A change from an accounting principle that

Q5: Hoffman Corporation had net income for the

Q6: On January 2, 2008, Ramos Co. issued

Q8: Eller, Inc., had 560,000 shares of common

Q9: If it becomes impracticable to use retrospective

Q10: At December 31, 2008, Norbett Company had

Q11: At December 31, 2007, Pratt Company had

Q12: A corporation's capital structure is simple if