Multiple Choice

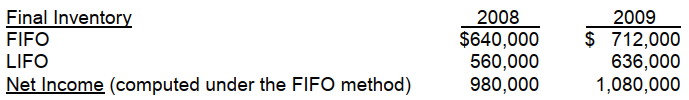

Eaton Company began operations on January 1, 2008, and uses the FIFO method in costing its raw materials inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed: Based on the above information, a change to the LIFO method in 2009 would result in net income for 2009 of

Based on the above information, a change to the LIFO method in 2009 would result in net income for 2009 of

A) $1,120,000.

B) $1,080,000.

C) $1,004,000.

D) $1,000,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Antidilutive securities are securities which upon their

Q46: The FASB takes the position that companies

Q47: In the diluted earnings per share computation,

Q48: The treasury stock method will increase the

Q49: A company should report per share amounts

Q51: According to the FASB, which approach is

Q52: Foley Company has 1,800,000 shares of common

Q53: On January 1, 2005, Dent Co. purchased

Q54: Royce Co. had 2,400,000 shares of common

Q55: Companies account for a change in depreciation