Multiple Choice

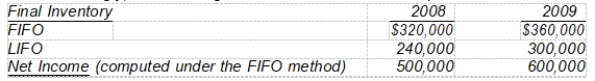

Hannah Company began operations on January 1, 2008, and uses the FIFO method in costing its raw materials inventory. Management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed: Based upon the above information, a change to the LIFO method in 2009 would result in net income for 2009 of

Based upon the above information, a change to the LIFO method in 2009 would result in net income for 2009 of

A) $540,000.

B) $600,000.

C) $620,000.

D) $660,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: On January 1, 2007, Gregg Corp. acquired

Q24: On January 2, 2008, Dino Co. issued

Q25: Ferry Corporation had 300,000 shares of common

Q26: On January 1, 2006, Lynn Corporation acquired

Q27: When a company changes an accounting principle

Q29: The estimated life of a building that

Q30: At December 31, 2007, Kegan Co. had

Q31: Stone Company changed its method of pricing

Q32: Which of the following is not a

Q33: Weaver Company changes from the LIFO method