Multiple Choice

In 2005, Hume, Inc. purchased Rousseau Metals for $3 million. At December 31, 2008, the Rousseau division reported net assets of $3,300,000 (including $1,700,000 of goodwill) . Hume reviewed the Rousseau division and determined that expected net future cash flows equal $2,500,000 and the fair value is estimated to be only $1,800,000. What entry should Hume record concerning the Rousseau division on December 31, 2008?

A) No entry is needed.

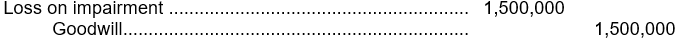

B)

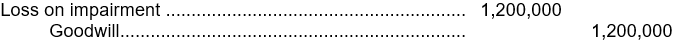

C)

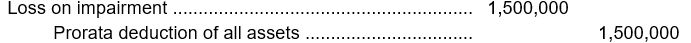

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q12: For indefinite-life intangibles, a recoverability test is

Q13: During 2008, Leon Co. incurred the following

Q14: The accounting profession does not allow the

Q15: On January 2, 2005, Koll, Inc. purchased

Q16: How should research and development costs be

Q18: Jo Jo Chong, Inc. needs to

Q19: Easton Company and Lofton Company were combined

Q20: Riser Corporation was granted a patent on

Q21: A trademark may properly be considered to

Q22: Acceptable accounting practice requires that disclosure be