Multiple Choice

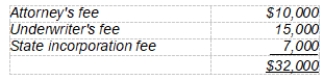

Calvin Company incurred the following costs related to the start-up of the business:

The company wishes to amortize these costs over the maximum period allowed under generally accepted accounting principles. Assuming that Calvin Company began operation on January 1, 2008, what amount of the start-up costs should be amortized in 2009?

A) $4,400

B) $2,200

C) $800

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Jo Jo Chong, Inc. needs to

Q19: Easton Company and Lofton Company were combined

Q20: Riser Corporation was granted a patent on

Q21: A trademark may properly be considered to

Q22: Acceptable accounting practice requires that disclosure be

Q24: Isa Company has equipment that, due to

Q25: Use of the master valuation approach to

Q26: On June 30, 2008, Cey, Inc. exchanged

Q27: Which of the following legal fees

Q28: MaBelle Corporation incurred the following costs in