Short Answer

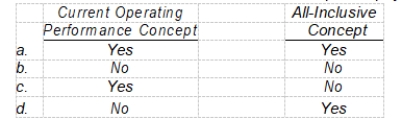

Any gain or loss experienced by a concern, whether directly or indirectly related to operations, contributes to the long-run profitability and should be included in the computa-tion of net income. Those who favor such a philosophy adhere to the

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Phasing out of a product line or

Q2: The multiple-step income statement recognizes a separation

Q3: The following items were among those that

Q4: Silas Company reported the following information for

Q6: An example of an extraordinary loss is

Q7: One of the primary benefits of the

Q8: Carpino Corporation has an extraordinary loss of

Q9: Changing the basis of inventory pricing from

Q10: Simmons Corporation reports the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB10226/.jpg"

Q11: To be classified on an income statement