Multiple Choice

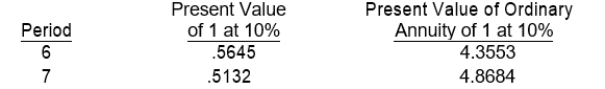

On January 1, 2008, Lex Co. sold goods to Eaton Company. Eaton signed a noninterest-bearing note requiring payment of $80,000 annually for seven years. The first payment was made on January 1, 2008. The prevailing rate of interest for this type of note at date of issuance was 10%. Information on present value factors is as follows: Lex should record sales revenue in January 2008 of

Lex should record sales revenue in January 2008 of

A) $428,419.

B) $389,472.

C) $348,424.

D) $285,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Ed Sloan wants to withdraw $20,000 (including

Q10: Items 52 through 55 apply to the

Q11: Schmitt Corporation will invest $10,000 every December

Q12: Linton Corporation will invest $10,000 every January

Q13: Items 48 through 51 apply to the

Q15: Which of the following is false?<br>A) The

Q16: On January 1, 2007, Carly Company decided

Q17: Items 48 through 51 apply to the

Q18: Jasper Company will invest $300,000 today. The

Q19: On December 1, 2008, Michael Hess Company