Essay

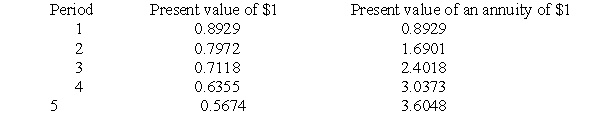

A firm is considering two alternative projects. Project A requires an initial expenditure of $100,000 plus an expenditure of $10,000 at the end of each the next five years. It will yield $98,000 in revenue at the end of the first year and at the end of the fifth year. Project B requires an initial expenditure of $50,000. It will yield $15,000 in net revenue at the end of each of the next five years. Both projects have a life of five years with no salvage value or disposal cost. The table below provides present value factors for the firm's discount rate of 12%. Calculate the net present value and profitability index of each project. Which project is preferred by each criterion?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A firm is considering two alternative projects.

Q3: A firm's marginal cost of capital (i)

Q4: A firm is considering two capital investment

Q5: Firms generally use only one of the

Q6: A firm's marginal cost of capital (i)

Q7: A firm is considering two capital investment

Q8: A firm is considering three investment projects

Q9: According to the 1977 study by Gitman

Q10: A firm has found that the net